Kazakhstan Tests Programmable CBDC to Enhance Fund Allocation on Railway Construction

The National Bank of the Republic of Kazakhstan has announced the successful launch of a pilot project aimed at using the digital tenge platform (DT) for budget expenditures. This initiative, financed by the National Fund, marks the second phase in the introduction of Kazakhstan’s national digital currency, focusing on the programmability of digital tenge. As […]

Putin Calls for Robust Development Framework for Digital Assets in Russia

In a significant move towards modernising the Russian financial landscape, President Vladimir Putin has underscored the necessity for developing a comprehensive framework for the integration and utilisation of digital assets. Speaking at a recent meeting on economic matters, Putin highlighted the strategic importance of creating favourable conditions to foster the growth of digital assets, including […]

BIS Release Results of Survey on CBDCs and Cryptocurrency

94% of central banks are actively exploring the development of a central bank digital currency (CBDC), and the results from an extensive survey performed by the Bank for International Settlements (BIS) involving 86 central banks highlights a significant increase in experiments and pilot programmes, particularly in advanced economies, with a notable rise in activity among […]

How Star Wars and Star Trek Got The Future of Money So Wrong! | Poundcast Episode 17

In episode 17 of the Poundcast, we are thrilled to host technologist and thought leader Dave Birch. With a rich background in secure communications and financial services, Dave shares his insights on the evolution of money from physical forms to digital assets. We delve into the historical context of money, discuss the role of digital […]

Driving growth in digital assets markets

Source: Quant Quant Founder and CEO, Gilbert Verdian, recently had an in-depth conversation with Dominic Hobson, the co-founder of Future of Finance. They delved into the opportunities, challenges, and threats related to accelerating institutional adoption of digital assets. There are many factors encouraging, shaping and, in some cases, preventing the emergence of large-scale, global digital […]

SETL Joins the Digital Pound Foundation Membership Community

We are very pleased to announce the addition of SETL to the Digital Pound Foundation’s membership community. SETL joins the Foundation as an Associate Member and will participate in, among other activities, the Use Case Working Group and Policy, Legal and Regulatory Working Group. SETL is an enterprise DLT firm which is part of the […]

Insights from Ripple’s President: SEC Battles, Payment Innovations, and Stablecoins

In a recent episode of ‘The Scoop Podcast’ by The Block, Monica Long, President of Ripple, offered a detailed discussion about the strategic movements of Ripple, especially in relation to XRP and the company’s new venture into stablecoins. Monica Long elaborated on how the clarity obtained from last July’s U.S. court decision—which confirmed XRP is […]

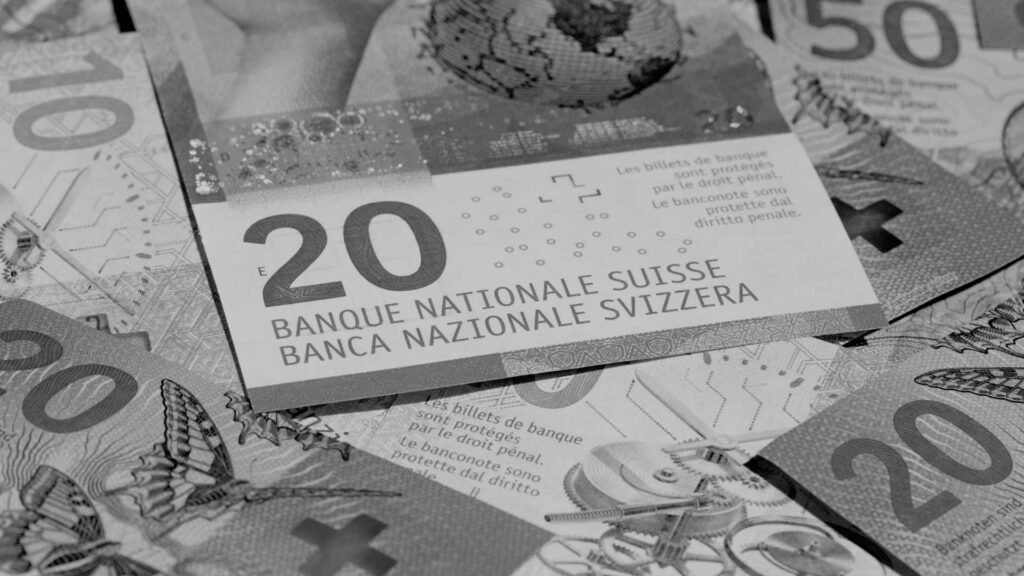

Swiss National Bank and SDX Extend Project Helvetia CBDC Project for Two More Years

The Swiss National Bank (SNB) and the SIX Digital Exchange (SDX) have announced that they will extend their exploration of wholesale central bank digital currencies (CBDCs) for an additional two years. This extension is a part of the ongoing Project Helvetia, which is now entering its third phase. The project aims to further integrate CBDCs […]

Global Counsel partners with the Digital Pound Foundation

We are delighted to announce that Global Counsel has become a strategic partner of the Digital Pound Foundation (DPF). Global Counsel is a global strategic advisory firm providing integrated consultancy services to clients working with policy change. Global Counsel and the DPF will collaborate on areas of overlapping interest across their policy and advocacy activities, […]

Italian Banking Association Reports Success in Wholesale CBDC Trial Project Leonidas

The Italian Banking Association (ABI) has announced the successful trial of a wholesale central bank digital currency (wCBDC) known as Project Leonidas, conducted as part of the Bank of Italy’s sandbox. The trial, which took place last year, highlighted benefits such as atomic transactions, transparency, and information traceability. The testing phase occurred in 2023, prior […]