Source: Atlantic Council

2023 is already shaping up to be a major year in central bank digital currency (CBDC) exploration. As of March 1, sixty-five countries are in the advanced stage of development, and over twenty central banks have launched their pilots, including Brazil, Japan, and Russia. To dive deeper into these countries, follow our CBDC tracker, where we track and update developments in 119 countries, representing more than 95 percent of the world’s GDP.

Despite only being three months into 2023, these 18 countries have made significant progress on central bank digital currencies.

Country Updates

Australia

Commonwealth Bank and the Australia and New Zealand Banking Group have joined the Reserve Bank of Australia’s pilot program to explore use cases of the eAUD. They will work alongside twelve other financial institutions and payment companies to test their CBDC.

Brazil

After conducting a closed pilot program with financial institutions in 2023, the Central Bank of Brazil president Roberto Campos Neto says he aims to launch a CBDC in 2024.

Canada

In 2023, Bank of Canada released an analytical note, highlighting the importance of offline payment functionality in CBDCs.

China

In January 2023, China included e-CNY in their currency circulation calculations. The e-CNY represented 0.13 percent of cash and reserves held by the central bank.

India

In 2023, India’s largest retail chain, Reliance Retail, will start accepting payments in digital rupee in stores during its pilot stage. In March, India began testing an offline functionality for its CBDC.

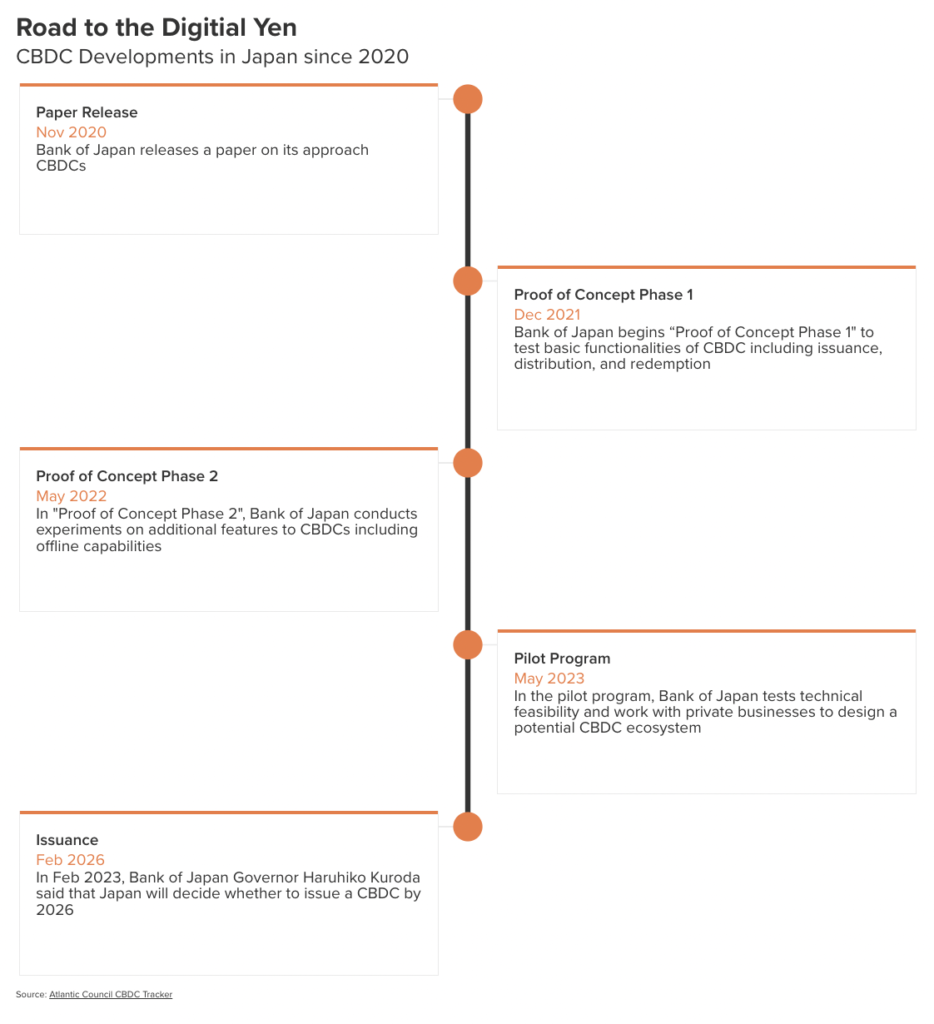

Japan

After completing their proof of concept, the Bank of Japan will begin a pilot program in April to test the technical feasibility of “digital yen.” Japan will also establish a CBDC forum, inviting private businesses engaging in retail payments or related technologies to participate in the discussion. Based on the results, the bank will decide whether to launch a digital currency by 2026.

Jordan

In February 2023, The International Monetary Fund released a technical market report on implementing a retail central bank digital currency. The report concluded that a cross-border rCBDC would be especially beneficial to Jordan.

Kazakhstan

In 2023, the National Bank of Kazakhstan launched a pilot for their CBDC, which is set to run through 2025.

Laos

In 2023, Laos’s central bank will start testing a prototype, named Digital Lao Kip (DLak).

Montenegro

Prime Minister Dritan Abazović announced that Montenegro is pursuing a digital currency in partnership with Ripple, a payment settlement asset exchange and remittance system.

Phillippines

In January 2023, the central bank of the Philippines announced that its pilot project, which tests wholesale CBDC, will run until 2024 with select financial institutions.

Russia

The Bank of Russia is preparing to roll out the first consumer pilot for the digital ruble on April 1, 2023.

Saudi Arabia

In January 2023, the Saudi Central Bank announced that it is increasing research into CBDCs, with a focus on domestic wholesale CBDC use cases with local commercial banks and fintech partners.

Turkey

In December 2022, the Central Bank of the Republic of Türkiye announced that it had successfully executed its “first payment transactions” using the digital Lira. It intends to launch a central bank digital currency in 2023.

United Arab Emirates

In 2023, as part of its financial infrastructure transformation program, the United Arab Emirates is planning to launch a CBDC in hopes to address inefficiencies in cross-border payments and drive innovation domestically. In March, the United Arab Emirates will explore a development and interoperability CBDC framework with the Reserve Bank of India.

Ukraine

In January 2023, Ukraine’s deputy prime minister announced that he will take his salary in e-hryvnia. The Ministry of Digital Transformation’s initial plan was to start the pilot phase in 2024 but the government now is pushing to launch the pilot in 2023.

United Kingdom

In February 2023, the Bank of England and HM Treasury released a consultation paper outlining the case for a digital pound. The paper concluded that it is too early to decide whether to introduce the digital pound but that preparation towards that decision is ongoing.

United States

US Treasury Undersecretary for Domestic Finance Nellie Liang announced the creation of an interagency working group to explore the development of a CBDC during a speech at the Atlantic Council. She noted that this group will comprise representatives from the Treasury Department, the Federal Reserve, the National Security Council and other respective government agencies.

Cross-border Projects

Project Polaris

The Bank for International Settlements Innovation Hub’s Nordic Centre is launching Project Polaris to explore security and resilience in CBDC systems as well as on and offline payments functionality. The project will begin with an analytical report on offline payment possibilities for CBDC systems. This is followed by a “deep-dive” event where invited vendors discuss their solutions to potential risks and scalability options for offline CBDCs.

Wholesale vs. Retail CBDC

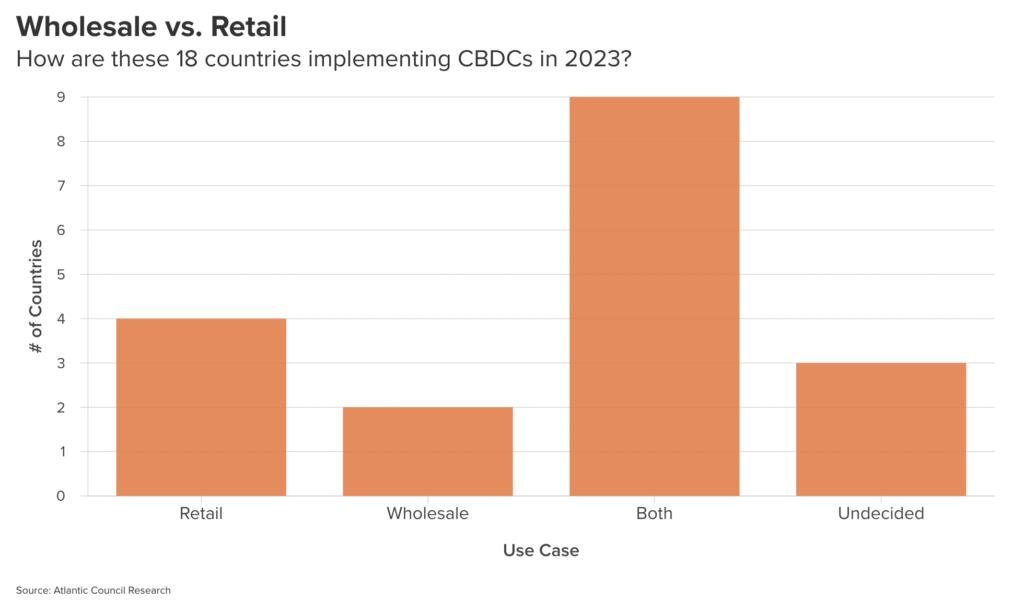

A necessary choice that countries find themselves making is deciding between wholesale CBDC and retail CBDC.

To summarize, a wholesale CBDC is used by financial institutions for bank-to-bank transactions and settlements. For example, wholesale CBDCs have been used to facilitate efficient cross-border payments among international financial institutions; they reduce costs, improve speed and reliability, and eliminate intermediaries.

A retail CBDC is more straightforward. This type of CBDC is available to the general public for all transactions relating to the purchase of goods and services. In simpler terms, it can be used in the same way as cash, but in a digital form.

Countries have also chosen to implement both wholesale and retail CBDCs. By building this hybrid infrastructure, central banks can use CBDC to settle transactions among financial institutions, and consumers also have the option to use CBDC for their retail payments. Australia, China, and India are just some countries that are piloting both use cases for their CBDCs.

The graph below shows how these 18 countries have decided to implement their CBDCs in 2023. Some have tackled both wholesale and retail CBDC projects, while others are still deciding.

Conclusion

The GeoEconomics Center will continue to track CBDC exploration around the world, as governments and central banks continue to adopt efficient, resilient, and inclusive digital solutions. To stay updated on these developments, follow our CBDC tracker and our Future of Money work. 2023 has just started, but we can expect much more from the digital currency world this year.