Source: Digital Bytes | Written by Jannah Patchay Executive Director and Policy Lead at the Digital Pound Foundation (DPF)

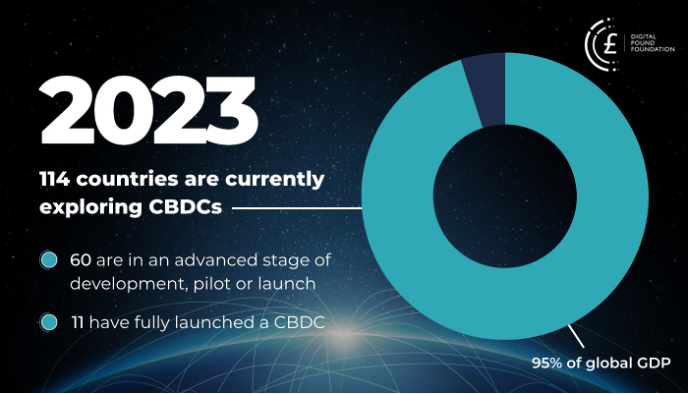

Central bank digital currencies (CBDCs) – a digital form of central bank-issued fiat currency – have seen an explosive growth in interest over the past four years. At the start of 2023, 114 countries, representing 95% of global GDP, are currently exploring CBDCs, of which 60 are in an advanced stage of development, pilot or launch, with 11 having fully launched a CBDC. This does not include China’s pilot, which currently reaches 260 million users and is expected to expand to most of the country in 2023.

Policy drivers and motivations

Each of these jurisdictions has its own unique blend of policy drivers and motivations. For the Bahamian Sand Dollar – the world’s first fully live CBDC, launched in October 2020 – introduction of a CBDC addressed the logistical issues involved in distributing cash to ATMs across nearly 700 islands (particularly during a pandemic), and modernising the country’s financial infrastructure. For Nigeria’s e-Naira, financial inclusion is a key driver, with the potential to improve remittances, offer access to the unbanked, and enable more effective government welfare distribution. In Sweden, which has experienced perhaps the sharpest decline in cash usage, the e-Krona project represents the country’s commitment to providing the public with continued access to public (central bank-issued) money, in a digital-native format and as a replacement for cash. For others, the opportunities presented by CBDCs are more overtly geopolitical in nature. Cambodia’s Bakong payments system (a so-called synthetic CBDC, which is issued privately but backed by reserves held at the central bank), also launched in October 2020 and had an explicit objective of strengthening the local currency, the Khmer riel, and correspondingly reducing dependence on USD in a highly dollarised economy – in other words, regaining a greater degree of monetary sovereignty. The EU sees the introduction of a digital Euro as a means not only of strengthening the monetary sovereignty of the Eurozone and fostering competition and efficiency in the European payment sector, but also of greater EU integration and strengthening the EU’s strategic autonomy and economic efficiency. For the United States, the most significant drivers of CBDC exploration are not modernisation of payments infrastructure, but rather the need to retain its influence on the world, both politically and economically.

Looking at the big picture

In our recent response to the Bank of England (BoE) and HM Treasury’s (HMT’s) Consultation on a Digital Pound, the Digital Pound Foundation observed a number of key policy drivers for the introduction of a retail CBDC in the UK – which, when extrapolated more broadly, can also apply generally to other jurisdictions seeking similar policy outcomes.

1. Central bank money as the anchor of monetary and financial stability – there is a role to be played by both retail and wholesale central bank money, as well as robust regulation and supervision, in maintaining trust in the financial and monetary system. As transactional use of cash – the only other form of publicly accessible central bank money available – continues to decline, it makes sense to maintain public access to public money through the introduction of a digital-native form of central bank-issued money both for transactional purposes and as a store of wealth. The BoE, in its Consultation, observes as well that the role played by a future CBDC in supporting the uniformity of money is not necessarily dependent on high public uptake of the CBDC; it is sufficient that it exists, and is accessible, and that other privately-issued forms of the national currency can be converted to it on demand and at par.

2. A vector for interoperability between new forms of digital money – the DPF envisages a future in which multiple different forms of money – both public and private, and both those currently in use as well as new forms of digital money – coexist. Each has the potential to fill a different niche in the ecosystem and to provide enhanced consumer and business choices, arising from their different characteristics, the technical functionality that they offer, the nature of their issuers and the risk (both real and perceived) attached to them as a consequence of all of these taken together. In order for our vision of a diverse, competitive and effective ecosystem for new forms of digital money to become a reality, seamless interoperability, convertibility, and – above all else – preservation of the singleness of a national currency in all its varied formats, will be required. Just as bank deposits can today be converted into cash, or e-money into bank deposits, the future evolution of money and payments will require equally seamless, trusted and invisible conversion between cash, bank deposits, e-money and new forms of public and private digital money. In such a mixed payments economy, CBDC can play a role in coexisting with, and complementing, systemically important stablecoins, tokenised deposits and tokenised e-money, and other new forms of digital money, and also providing a form of interoperability and rails between existing payment infrastructures and future digital platforms.

3. Platform for innovation – a CBDC can provide a platform for innovation in ways that might, at present, not be entirely foreseeable – much in the same way that the role of the smartphone in everyday life and the extent to which it has transformed the way in which people interact with each other, with services and with businesses, could not have been foreseen at the time the first iPhone came to market. There has also been a growing recognition of the wider benefits associated with CBDCs beyond their use as payments instruments. This includes opportunities for innovation and competition arising from a digital-native central bank-issued money offering programmable functionality. The existence of a CBDC that can be used, for example, to underpin settlement of digital asset transactions, or can have smart contracts embedded, is in itself an attractive feature and draw for innovative firms to locate themselves in a given jurisdiction. Nevertheless, the adoption of any CBDC is heavily dependent not only on its technical features but also on the way in which characteristics such as privacy, resilience, security, and consumer protection are built into its design and that of its accompanying infrastructure.

4. National security and monetary sovereignty – at present, the US dollar is either used directly for settlement or indirectly as an intermediary currency for settlement of 88% of all FX transactions globally. Along with the degree of dollarisation (partial or full) inherent in a number of jurisdictions, and the use by most central banks of the US dollar as a reserve currency, this reliance on the US dollar enables the US to exercise a significant degree of extraterritorial economic and political power in terms of sanctions enforcement and influence. Recent events in Ukraine, and the West’s response in cutting Russia off from the financial system, have further spurred interest from many jurisdictions in exploring CBDCs for cross-border payments as a means of insulating themselves from similar situations.

There is certainly an advantage to being a first mover, or an early adopter, with respect to CBDCs. Some jurisdictions may start to mandate payments to and from service providers in their own CBDC. If, for example, China were to do this with respect to its “Belt and Road” initiative, the consequences for uptake of its Digital Yuan CBDC and payments system – outside its own borders – would be significant, and could have knock-on effects in local economies, effectively leading to a reserve currency status in certain parts of the world. A CBDC, therefore, can have geopolitical impacts, and impacts on the monetary sovereignty of nations. Initially, at least, CBDCs represented a reaction from central banks to proposed new forms of privately-issued digital money, most notably Meta’s (formerly Facebook’s) Diem (formerly Libra). Even as the case for CBDCs has further broadened, privately-issued stablecoins continue to pose a potential challenge for the monetary sovereignty of some central banks. A US dollar-denominated stablecoin that is made available to consumers and businesses beyond the US could quickly begin to supplant the use of the local currency, particularly in times of currency volatility or political uncertainty (a situation which can arise even in economies such as the UK, as the turbulent events of 2022 have shown). For the impacted central bank, this could in turn lead to a creeping dollarisation effect and corresponding loss of monetary sovereignty domestically alongside loss of confidence on the world stage.

Conclusion

From an international perspective, it is becoming increasingly apparent that CBDCs are a necessity for any nation-state wishing to preserve its sovereignty in determining fiscal and monetary policy in a world that will be increasingly fuelled by both privately operated, decentralised digital currencies and other types of digital assets. The exercise of sovereign power by a nation is closely linked to its ability to leverage and exert influence through its currency and how that currency is perceived and used at both domestic and international levels. The introduction of a CBDC will have impacts and repercussions far beyond payments infrastructure. It can provide a platform for innovation that can support a jurisdiction’s transition to a digital economy. It is a fundamental infrastructure that can underpin the delivery of numerous policy objectives. Taking a forward-looking approach to policy and technology decisions will help deliver a design that is more future-proof and ultimately enable a jurisdiction to maintain a leading edge in an increasingly competitive global financial market and FinTech landscape.