Executive Summary

The Digital Pound Foundation Use Case Working Group led by William Lorenz has been working together to identify, develop and refine a series of key use cases that can be used to illustrate the potential of a retail digital Pound for the UK citizen. At the time of producing this article, the Use Case Working Group consisted of representatives from the following Digital Pound Foundation members: Accenture, Electroneum, Modulr, OneStep Financial, Quant, and Ripple.

During this work it became clear that whilst having a digital Pound has some benefits, and that there are most certainly opportunities for innovation in the payments space, the wider benefits are only fully realised when you have a digital ecosystem that supports and interacts with the digital Pound. We’re therefore not exploring use cases as a theme in isolation, rather examining how a digital Pound makes it easier to leverage the wider ecosystem benefits of a new era of the Internet.

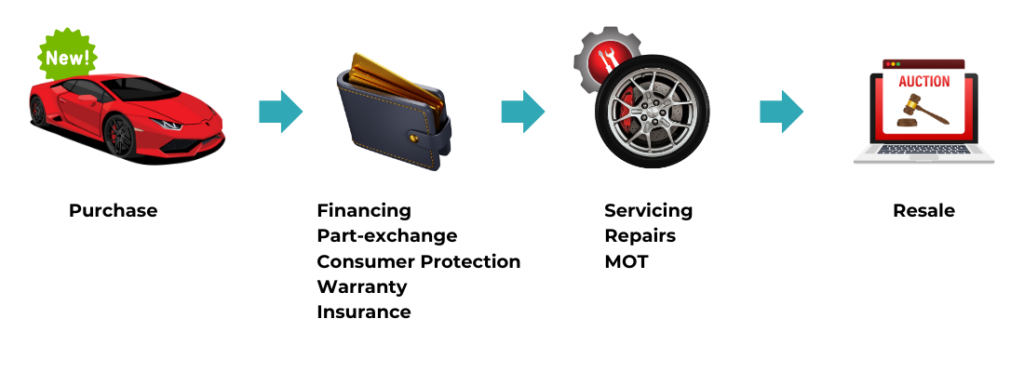

The use case discussed in this article explores the purchase of a car, which aside from buying a home is one of the largest purchases individuals make. Purchasing, owning and reselling a car comes with a series of friction points and risks, including the initial servicing and MoT inspections, funds transfer to secure the sale and then other related services such as warranty and insurance, and ultimately the process of reselling the vehicle.

Removing risks and providing certainty and visibility throughout the whole process provides a solid rationale for a compelling use case. In this article we explain how the digital Pound, when combined with tokenisation, can create a new ecosystem that makes car ownership experience more transparent, bringing benefits in terms of trust, speed and simplicity to all steps of the car ownership journey:

It is important to note that whilst we have focused on car purchasing in this article, the benefits explored here are applicable to other high-value complex purchases where there are multiple payment stages, financing, warranty, and proof of ownership requirements. Examples include other vehicle types, computers, televisual equipment and similar.

Introduction

The Digital Pound Foundation Use Case Working Group has been working together to identify, develop and refine a series of key use cases that can be used to illustrate the potential of a retail digital Pound for the UK citizen.

The group has focused on five use case themes:

- Making tax effortless

- Only pay for what I use

- Control your money

- Supporting sustainability

- Receiving grants you are due

This article will explore the Control your money theme.

Control your money

There were several contenders for the leading use case under this theme, from mortgages to auctions, ticket sales and cross-border trade, to smart borrowing – the general concept being that there are benefits to the retail user in being able to control when their funds are released based on certain tasks being fulfilled and validated. As the theme developed, we noticed a seamless alignment with the broader Web3 landscape.

Note: Web3 is an evolving concept of the next generation of the Internet, where users have more control and ownership. In this context, new forms of digital money, including CBDCs and other new forms of digital money including the digital Pound can become digital assets, enabling secure, automated and trustless transactions.

As we explore innovation opportunities for the digital Pound, we focus on payment upon delivery capabilities which mitigate the risk of non-payment, as well as programmability which enables features such as escrow and conditional payments to support an increase in efficiency and accuracy of various types of transactions, which are made on a daily basis.

From a wider perspective, we explore tokenisation of ownership and token histories with rich metadata covering other processes like warranties and insurance, resale in the second-hand market with protection and transparency for the seller and buyer.

High-value purchase

To illustrate this use case we’re focusing on the example of buying a car. A car is traditionally a large purchase for any individual and can range from a few hundred pounds to tens of thousands or more if you’re in the market for a supercar.

How it happens today

Today when you make a car purchase, you agree on the price and purchase details with the seller. At this point you may not have a clear picture of the vehicle’s history. You will need to sign a contract, which varies depending on how the purchase is being funded, and then place a deposit for the vehicle, usually using a debit card or bank transfer. In the case of a bank transfer you will likely not receive an immediate confirmation from the seller that the deposit has been paid (indeed sometimes this can take days), creating uncertainty and perceived risk – particularly if the deposit is significant and the seller is not known to you personally.

When you come to complete your car purchase this will usually require another debit card or bank transfer payment from yourself or the finance company, which is again subject to the same receipt of payment notification challenges. It is highly unlikely a seller will want cash at any point due to the increased risk of fraud combined with anti-money laundering requirements for larger purchases, whilst credit cards will be refused due to significant processing charges.

The complexity described here only relates to the main car purchase, and other related activities such as actual transfer of ownership, insurance, taxing the vehicle, car maintenance etc need to be dealt with separately. These add further complexity, uncertainty and risks.

How this could look in the future:

In this section we explain how tokenization and digital money can revolutionise the car ownership process by adding transparency, certainty, efficiency and accessibility to various aspects such as purchasing, servicing, warranties and more.

Car Building and NFT minting

Before you even set eyes on your new car, you know that it will have been through rigorous manufacturing and testing processes to ensure high quality build standards and your car is safe to be on the road. You may be buying the car brand new, or it may have passed through one or more owners previously.

In any case, right at the beginning of the car’s journey at the factory, a new Non-Fungible Token (NFT – form of tokenisation that is used to indicate ownership) could be minted and registered to the manufacturer’s wallet (a virtual wallet / application capable of storing tokens such as NFTs and digital currencies such as the digital Pound).

This NFT is tied to the Vehicle Identification Number (VIN) of the car, essentially meaning that the car itself has been tokenised and is recorded as owned by the manufacturer until the car is later sold to a dealer.

The NFT can store additional information such as images, the registration number plate when allocated, VIN, manufacturing date, and more detailed information such as the part numbers which make up the car.

Anything you need to know about that individual car or line of cars from that brand and manufacturer can be stored in a trustworthy place in the NFT. The information can be accessed and reviewed (as it could be stored on a permissionless chain where NFTs and transactions are visible if you have permission), meaning you could check all the details of the car – with confidence – before buying it!

It is encouraging to note that this isn’t as far-fetched as it may seem and early steps are already in place – Arnold Clark (the UK’s largest independent dealer) already organises its internal records by the individual car, not the customer and this could be extended to the use of tokenisation in order to realise some of the benefits as outlined below.

The purchase

You’ve been dreaming about the perfect car for months or even years. You’ve scoured car reviews, watched videos on YouTube, played with new car configurators, and searched through Autotrader. Finally you’ve done it and found the car of your dreams!

Before making your purchase you see the car is tokenised and has an accompanying NFT. It was sold by the previous owner to a local dealer who now owns the token alongside the physical car. You look up the car’s NFT and verify that the dealer is now the legal owner, the registration date and number plate are correct and additionally check manufacturing details. You can even check if any parts have been recalled, details of any repairs which have taken place and the service history!

At the dealership, you agree on a purchase price and financing deal. The dealer’s systems can take advantage of smart contracts to streamline the financing process and ensure a secure and transparent transaction. Here’s how this might work in detail:

- Smart contract for pre-arranged finance: the dealer can initiate a smart contract that outlines the terms and conditions of the financing agreement

- Conditional payment: the smart contract holds the funds allocated for the car purchase but doesn’t release them to the dealer immediately. Instead, the funds are locked in a secure escrow account.

- Criteria for payment release: successful credit check, transfer of the NFT token (representing car ownership), final customer consent etc.

- Payment Release: Once all conditions are met, the smart contract automatically releases the funds to the dealer. This process eliminates the need for manual verification and paperwork.

All actions related to the smart contract, including the credit check, ownership transfer, and payment release, are recorded immutably on the blockchain. This record enhances trust and accountability and is only visible to those with permission to view it.

While many of these checks and steps already exist, some, such as ownership and credit checks, finance applications and settlement, are painfully slow, as is the challenge with verifying your information. By utilising smart contracts, the car purchase process becomes more secure and efficient. It minimises the risk of disputes, delays, or fraud, as everything is automated and verifiable.

Part-exchange and HP settlement

As part of this transaction, you’re also selling your current car in part-exchange and need your existing Hire Purchase agreement settled by the dealer.

The digital Pound and smart contract can work together to conduct all of these transactions instantly:

- Selling your car to the dealer

- The dealer settling your current Hire Purchase agreement

- Transfer of the NFT to the dealer

- Dealer receiving funds from your new loan provider…

- …and also funds from your wallet for the deposit element of the purchase

- Finally the transfer of the NFT and car ownership to you

In the current siloed and opaque landscape this is a painful multi-stage process, however with a digital Pound combined with NFT functionality it could be significantly improved, becoming transparent and instant with all parties protected.

Consumer protection

A web3 ecosystem makes it easier to offer consumer protections via smart contracts. As part of the purchase a secondary smart contract can be automatically triggered covering the 14 day cooling off period and also the Hire Purchase six month warranty under the Consumer Credit Act (CCA).

If there’s a significant fault with the car within the CCA warranty period or you change your mind within the 14 day cooling off period, you have a greater degree of protection than previously, as the smart contract can support warranty claims plus the process of reverting loans and purchases, including restoring car NFT ownership to the dealer.

Servicing and MOT

You’ve had your wonderful new car for a year and the service and MOT are due, so you book it in. Forget VC5 forms or log books – you prove ownership and registration via the NFT in your wallet, and the dealership can view the car’s entire service, repair, modification and MOT history.

The car fails the MOT requiring new tyres, and it turns out there’s a recall on the handbrake cable – which was identified by the dealer or garage you normally use, due to the part number being searchable on the NFT.

Selling on the second-hand market

It’s been a few years and you need something new – perhaps the family has grown or you’ve just set your sights on something else. Either way it’s time to sell.

Instead of going to a dealer, you decide to sell your wheels on eBay. You’ve filled out the listing and added the car’s NFT so any prospective buyer can check out the history and trust they’re in good hands.

A buyer has bid on the car and won the auction! But unlike ordinary Web 2.0 auctions, they’ve place a bid using their wallet and eBay now utilises smart contracts to make their auctions more efficient and secure. One way of doing this is checking there are sufficient funds at point of bidding – to deter fraudsters or time wasters!

When the auction winner comes to collect the car, the smart contract gets even more useful. A multi-signature agreement is put in place where the buyer and seller’s agreement is made via their web3 wallets, and they can either agree to continue or drop out at any time.

Since the digital Pound can settle in real-time, and the smart contract has reserved funds in escrow at the point that both parties sign up to the deal, the purchase completes. This is particularly useful to protect against a common scam where an up front deposit is requested and the buyer is then ghosted.

On top of settlement of the funds themselves, the smart contract also transfers the car’s NFT, meaning even if the seller tries in some way to con the buyer by taking the money and keeping the car, the buyer has undeniable proof of ownership and traceability back to the seller’s wallet.

To put icing on the cake, when you originally bought the car you also purchased a service plan and warranty from the original dealer. These came as individual NFTs alongside the car and were automatically transferred to you upon purchase, which subsequently also get transferred to the car’s new owner upon resale.

Building blocks and why a digital Pound is needed?

The solution described above requires a number of building blocks to make it function:

- Tokenisation: Of the car data and ownership in the form of an NFT. This allows physical assets such as cars to be represented as digital tokens on a blockchain. Each car has a corresponding NFT (Non-Fungible Token) that signifies its ownership and authenticity.

- Smart contracts: Self-executing contracts with the terms of the agreement directly written into code. They automate the execution of tasks and conditions within the car purchase process and include release of the digital currency.

- 2 or 3 Party Locks: Depending on the complexity of the transaction, smart contracts can incorporate 2 or 3 party locks. These locks ensure that certain parties, such as the buyer, seller, and possibly a third-party verifier (e.g. a credit agency) all agree to release the funds or complete the transaction.

- Digital Escrow Functionality: This ensures that funds are held securely until specific conditions are met. In this context payment for the car, in the form of digital money, is kept in escrow until all criteria are satisfied.

- Programmable Rule-Based Payments: Smart contracts can be programmed with rules that dictate when and how digital money payments should occur. For instance, funds may only be released when all conditions, as defined in the contract are met.

These all need to interact closely with the underlying payment mechanism, and current methods such as cards or bank transfer do not have the sophistication and capabilities required. It is expected that all of these elements will, however, be included in the ecosystem required to support any digital Pound design.

With the right design, the digital Pound has the potential to become a cornerstone of the emerging digital ecosystem. It can become a platform for innovation and a bridge between traditional finance and Web3 applications described earlier.

We therefore conclude that new forms of digital money have the potential to serve as a trusted and stable medium of exchange within a new, Web3-based car purchase system.

This article was produced by the Digital pound Foundation’s Use Case Working Group, led by William Lorenz. Members who contributed to the development of this article included: Accenture, Electroneum, Modulr, OneStep Financial, Quant, and Ripple. If you are interested to learn more about this working group and how you could get involved, head over to our Use Case Working Group Page.