Join the Digital Pound Foundation to access exclusive Working Groups, projects, and speaking opportunities. Shape the future of digital money, showcase your expertise, and connect with a vibrant community of thousands of digital money professionals and enthusiasts through our events, website, social media, and monthly newsletter.

Engage in our working groups to learn, discuss new approaches, and collaborate on projects, including consultation responses, proofs of concept and thought-leadership articles and papers. Members are also invited to initiate new working groups on key topics, and we provide support to ensure these are successful.

Members are prioritised for speaking opportunities at our regular in-person and online events, and we collaborate with our members to deliver webinars on areas of mutual interest. We also host frequent roundtables on key topics, with policy-makers and regulators such as the Bank of England often joining to observe.

Our community is well-informed insightful, and diverse. We have an extensive online reach through our website, social media channels, and monthly email newsletter. We work with our members to help share their relevant news and projects across our community through these channels, as well as our online and in-person events.

Our working groups provide our membership community with opportunities to collaborate, discuss new approaches, and promote thought leadership. We are keen to go beyond just discussion wherever possible, and are currently working on several proofs of concepts. We work closely with our working groups to ensure we are promoting the outputs appropriately, and they inform many of the in-person conferences and networking events, webinars, and roundtables we hold. Members also have the opportunity to set up new working groups, and we will support them to do this, inviting other members and industry participants to join, ensuring cross organisational information flows, and helping to promote any outputs generated.

This Working Group will explore a variety of topics and activities designed to promote the transition to a sustainable financial system through the adoption of digital finance and frontier technologies. Including the potential of different forms of a digital Pound, this Working Group will seek to identify opportunities to advance sustainable finance practices.

Led by Diego Ballon Ossio (Partner at Clifford Chance) and Chris Glennie (Partner at CMS), this working group explores the risks, challenges, and benefits of digital currencies like CBDCs, stablecoins, and e-money tokens and publishes related thought-leadership. This group also collaborates on consultation responses and plans engagement with policy makers.

Led by William Lorenz, a DPF individual expert member, the Use Case working group has defined a number of retail use cases for a digital Pound, hosting sessions with regulators, banks and other stakeholders to help with this. Informed by academic research, the working group is beginning to develop pilots and proofs of concept to test these use cases.

Led by Alexandre Neves (Manager of Strategy & Consulting Payments at Accenture), this working group provides a forum where members explore significant topics such as the payment rails of the future, and how new forms of digital money may impact the cross-border payments ecosystem.This group also recently lead for the DPF in developing the Digital Currency Glossary.

Led by David Rennie, a DPF individual expert member with 18+ years immersed in the debate surrounding identity in the UK, this working group discusses privacy and identity in relation to a digital Pound, and creates principles for evaluating solutions which can aid decision-makers. The group are currently developing a KYC related proof of concept.

In addition to full membership, which provides you with access to all our Working Groups, we are also now offering a discounted ‘Single Working Group Membership Package’, providing access to a choice of two of our Working Groups: Digital Sustainable Finance Working Group or Privacy and Identity Working Group. Don’t worry, you can choose to upgrade your membership at any stage should you later wish to gain access to all our Working Groups. For more information, simply download our membership pack or schedule a call using the buttons below.

We organise regular in-person and online events throughout the year to explore both fundamental questions related to the development of new forms of digital money, as well as emerging topics. All our events are available for members to attend, even if the attendance limit has been reached – and we actively work with each member to ensure speaking opportunities are provided fairly, and on topics that are of most interest to them.

Roundtable Discussions

25-30 invited guests per roundtable

Our roundtables bring together our membership community and special guests from the public and private sectors. Here is an example of our “CBDC: an opportunity to re-think AML regulations?” roundtable, in which we discussed the current methods of detecting and preventing money laundering and criminal finance, and whether a digital Pound could provide some new opportunities. The discussion has led to the Privacy & Identity Working Group exploring a proof of concept related to this.

Networking Events & Panels

100-200 invited guests per event

At least twice a year we host in-person events for our membership community and special guests from the public and private sectors. Last year, for example, we hosted a panel and networking event that aimed to explore the geopolitical considerations that governments and central banks must take into account when deciding whether and how to introduce a CBDC. This year, we’re excited to be hosting our ‘Digital Money 2024’ event, with various opportunities available to members.

Live Webinars

300-1,800 registrations per webinar

Throughout the year we host regular live webinars across a variety of important topics covered by our working groups and in response to emerging issues. We also host webinars on specific topics that our members wish to explore. Here is an example of our ‘Navigating the Future Stablecoin Market’ webinar, which brought together leading experts for a panel discussion on the practical use cases for stablecoins and the future operating models for issuers and service providers.

We aim to be a centre of subject matter expertise in the UK with respect to new forms of digital money. We have developed a network of trusted partners whose advocacy and policy objectives align with our own. As a member of the Digital Pound Foundation, you will also have the opportunity to work with our partners across collaborative projects.

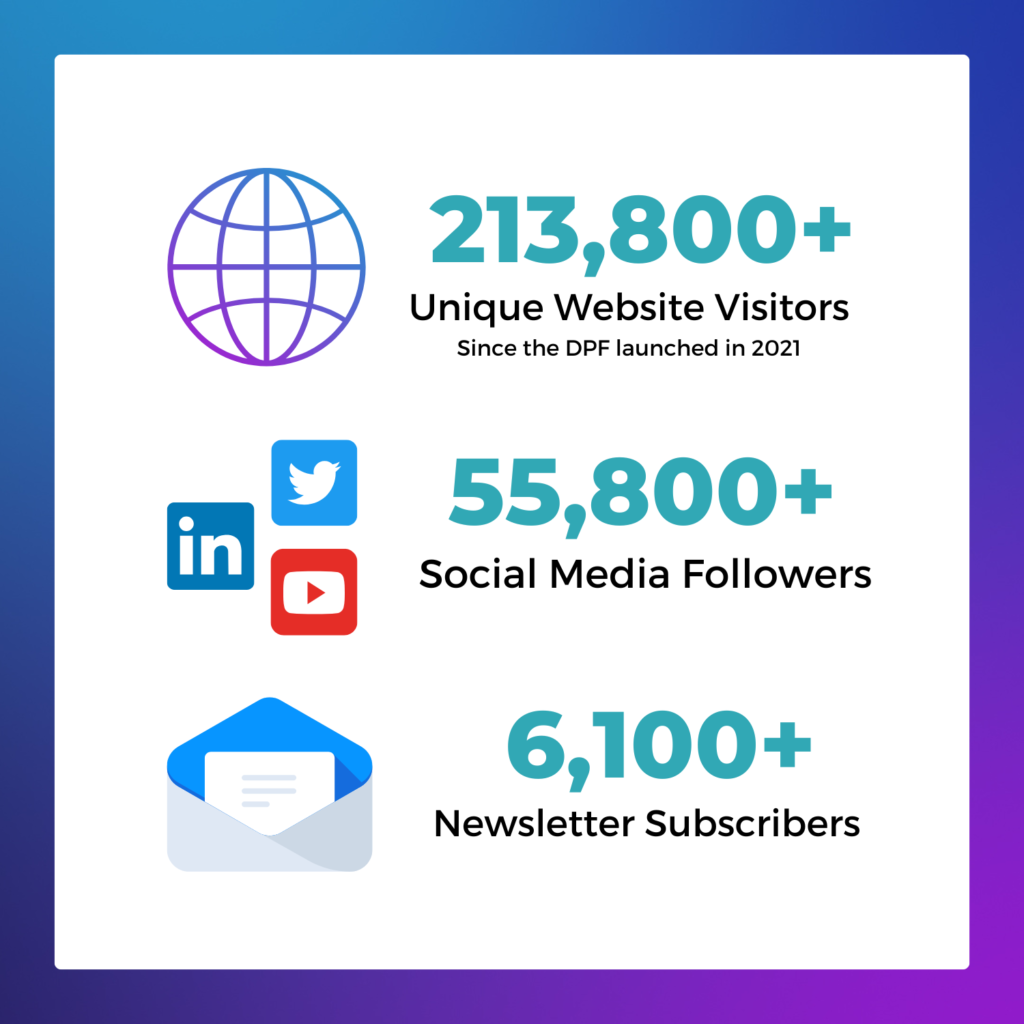

Since the Digital Pound Foundation launched in October 2021, we have developed a large and diverse audience in the UK and worldwide, interested in the development of new forms of digital money. Coming from a wide variety of sectors including both central and commercial banks, fintech, blockchain providers and retail companies, this community provides us with excellent reach to promote our work, and the work of our members.

Unique Visitors

Social Media Followers

Email Subscribers

Representative sample of organisations subscribed to our monthly newsletter:

For more information about our various membership, including a breakdown of our full and discounted membership packages, you can download a copy of our membership pack by completing the form below.

Schedule a 15-minute call with our Membership & Community Lead, Michelle Brook, who would be happy to talk through the various options that are available to you, depending on your company size, type, and requirements.