Exploring the Evolution of Digital Money – what’s on the Horizon for 2024?

Date: Wednesday 31 January 2024Location: London, UK To mark our 2nd anniversary, on 31 January, the Digital Pound Foundation held an in-person event examining developments in new forms of digital money, looking back at the key highlights of 2023, as well as ahead to 2024, with a particular focus on policy development globally. The event opened with […]

The Digital Evolution of Money, a New Whitepaper from Ripple

The financial world stands on the brink of a historic transformation, as Central Bank Digital Currencies (CBDCs) are rapidly evolving. Ripple, a member of the Digital Pound Foundation, has this week published a brand new whitepaper entitled “The Digital Evolution of Money” and is a must-read for policymakers, financial experts, and anyone interested in the […]

Ripple: Demystifying Central Bank Digital Currencies

Source: Ripple Central Bank Digital Currencies (CBDCs) have been making waves in the world of finance, offering a groundbreaking intersection between traditional fiat currencies and the digital realm. In this first piece of a broader series, we will delve into the world of CBDCs, explaining what they are, how they work, and why they are becoming […]

Project Helvetia Phase III: Basel-City and Zurich Spearhead wCBDC Bond Issuances on DLT Platform

Earlier this month, Cantons of Basel-City and Zurich completed the issuance of digital bonds utilising a Swiss Franc (CHF) wholesale central bank digital currency (wCBDC), provided by the Swiss National Bank (SNB) through the SIX Digital Exchange (SDX). This achievement forms a crucial part of Project Helvetia Phase III, unveiled by the SNB on November […]

Phase 2 CBDC Pilot Transitions to Offline Payments, with JCB, IDEMIA, and Soft Space

The JCB Digital Currency (JCBDC) initiative, spearheaded by JCB in collaboration with IDEMIA and Soft Space, has entered its second phase. This project is focused on enhancing Central Bank Digital Currency (CBDC) transactions. During the initial phase, the team developed a CBDC payment system that allowed merchants to accept digital currency payments without altering their […]

CBDC: an opportunity to re-think AML regulations?

On 6th December 2023, the Digital Pound Foundation hosted an in-person roundtable consisting of a selection of our Privacy and Identity Working Group members and external participants. The purpose of the roundtable was to share our thinking around the implementation of AML regulations in the digital age and gather feedback from the external participants. This […]

Italy and Korea Forge Partnership on CBDC and RTGS Technology Innovations

The Bank of Italy and the Bank of Korea have signed a memorandum of understanding (MOU) focused on exchanging expertise in technologies supporting Real-Time Gross Settlement (RTGS) systems and central bank digital currencies (CBDCs). Their approaches to CBDCs, however, differ significantly. The Bank of Korea is exploring a wholesale CBDC aimed at enhancing tokenized bank […]

New report from UK Parliament shares current position on digital Pound CBDC

As the world of finance rapidly evolves, the UK is contemplating the introduction of a Central Bank Digital Currency (CBDC), specifically a retail CBDC or ‘digital Pound.’ This concept differs from cryptocurrencies like Bitcoin and Ether, as it would be a direct liability of the central bank. UK Parliament recently published a report entitled “The […]

Bokolo Cash: The Solomon Islands’ New Digital Currency Initiative

The Solomon Islands’ Central Bank has initiated a trial for a new digital currency, named Bokolo Cash. This project, supported by the Japanese blockchain company Soramitsu, aims to introduce a central bank digital currency (CBDC) equivalent to one Solomon Islands dollar. Bokolo Cash will be usable in retail environments within Honiara, the nation’s capital, and […]

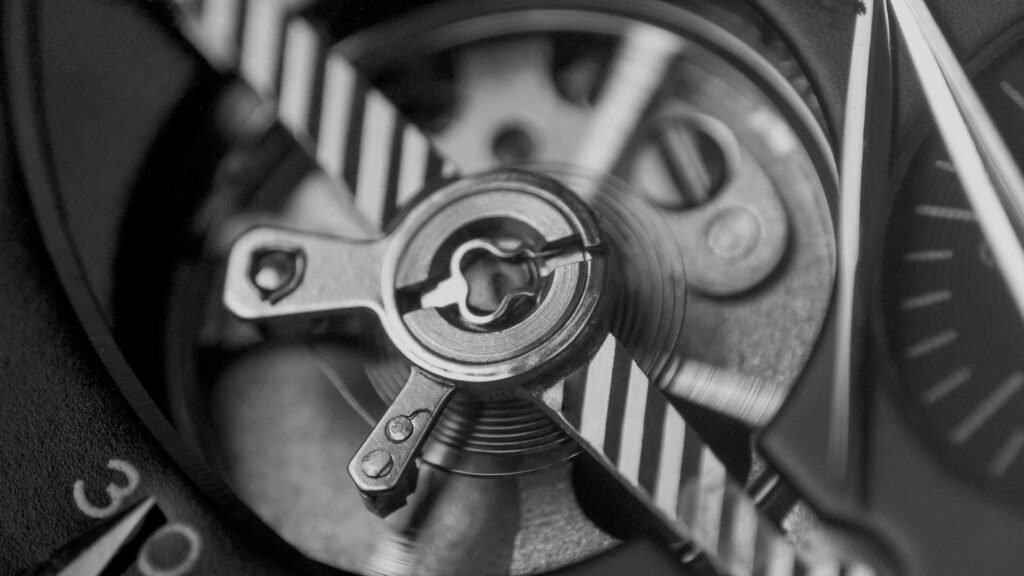

Project Tourbillon: Balancing Anonymity and Security in the CBDC Landscape

The Bank for International Settlements (BIS) has today released a new report from Project Tourbillon. In an era where digital transactions are rapidly outpacing cash, Project Tourbillon aims to explore the intricate balance of privacy, security, and scalability in Central Bank Digital Currencies (CBDCs). This project, a response to the global decline of cash usage […]