BIS Release Results of Survey on CBDCs and Cryptocurrency

94% of central banks are actively exploring the development of a central bank digital currency (CBDC), and the results from an extensive survey performed by the Bank for International Settlements (BIS) involving 86 central banks highlights a significant increase in experiments and pilot programmes, particularly in advanced economies, with a notable rise in activity among […]

BIS Outlines Six New Projects Focussed on Tokenization, AI and Big Data, Privacy and Security, and Environmental Sustainability

The Bank for International Settlements (BIS) has outlined its 2024 work programme, introducing six new projects focusing on digital financial technologies. These projects aim to address various challenges in the financial sector, including security and environmental sustainability. The upcoming projects in the 2024 agenda include: Cecilia Skingsley, Head of the BIS Innovation Hub, commented on […]

Project Promissa: A New Collaboration Between World Bank, Swiss National Bank and the BIS Innovation Hub to Test Financial Instrument Tokenization

Project Promissa, a new collaboration announced between the BIS Innovation Hub Swiss Centre, the Swiss National Bank, and the World Bank, is spearheading an experiment to revolutionise the way financial instruments, particularly promissory notes, are managed. These notes, traditionally paper-based, are crucial in funding international financial institutions, including multilateral development banks. As part of a […]

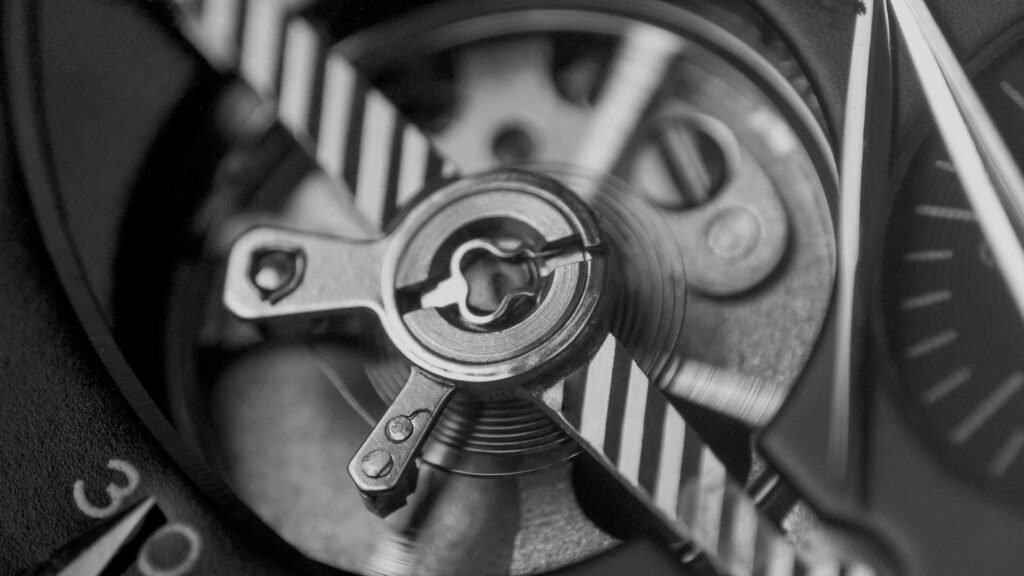

Project Tourbillon: Balancing Anonymity and Security in the CBDC Landscape

The Bank for International Settlements (BIS) has today released a new report from Project Tourbillon. In an era where digital transactions are rapidly outpacing cash, Project Tourbillon aims to explore the intricate balance of privacy, security, and scalability in Central Bank Digital Currencies (CBDCs). This project, a response to the global decline of cash usage […]

The Future of Finance: BIS General Manager Highlights Cybersecurity in CBDC Development

In a significant gathering convened by the Bank for International Settlements (BIS) in Basel, Switzerland, Agustín Carstens, the General Manager of BIS, underscored the pivotal role of cybersecurity in the realm of Central Bank Digital Currencies (CBDCs). Addressing a global assembly of financial experts, Carstens heralded CBDCs as the cornerstone of a rapidly approaching digital […]

The Truth About Stablecoins: Are They as Stable as Promised?

In the dynamic world of cryptocurrency, stablecoins have emerged as a promising bridge between traditional finance and the novel crypto market. A new paper from the Bank for International Settlements delves into this growing sector, questioning the ‘stability’ of stablecoins—a key selling point that distinguishes them from their more volatile counterparts. Stablecoins, designed to be […]

BIS Unveils Comprehensive Guide on Offline Payments for CBDCs

The BIS Innovation Hub has recently published a pivotal high-level design guide for Central Bank Digital Currencies (CBDC) as a part of its ongoing Project Polaris, focusing on the intricate realm of offline payments. Creating an effective offline payment system using CBDC is a formidable task, fraught with challenges and requiring careful consideration of various […]

Project Mariana: Final Report Confirms Successful Cross-Border Trading Of Wholesale Central Bank Digital Currencies (wCBDC)

The Bank for International Settlements (BIS) in collaboration with the central banks of France, Singapore, and Switzerland has successfully trialed cross-border transactions using wholesale central bank digital currencies (wCBDC). This was revealed in a report released on Thursday. You can download it here. Under the banner of Project Mariana, a prototype was developed using simulated […]

BIS: Stablecoins vs. Tokenized Deposits – Implications for the Uniqueness of Currency

The modern monetary system rests upon a fundamental concept known as the “uniqueness of currency.” This principle ensures that monetary transactions are not subject to fluctuating exchange rates between various forms of money, whether they are privately issued (e.g., deposits) or publicly issued (e.g., cash). The uniqueness of currency establishes an unequivocal unit of account […]

Project Polaris: Handbook for offline payments with CBDC

Source: BIS DOWNLOAD THE HANDBOOK A survey conducted by the BIS Innovation Hub Nordic Centre shows that 49% of central banks consider offline payments with retail CBDC to be vital, while another 49% deemed it to be advantageous. Providing offline payments with CBDC is an important requirement for many central banks for reasons such as […]