Escalating approval of Central Bank Digital Currencies (CBDCs) receives reinforcement from ongoing domestic trials and transnational endeavours in diverse jurisdictions, according to a study conducted by the prominent banking institution, Citi. In the context of discussions aiming to truncate local financial settlement cycles within the forthcoming five years, the majority of securities firms are setting their sights on Central Bank Digital Currencies (CBDCs).

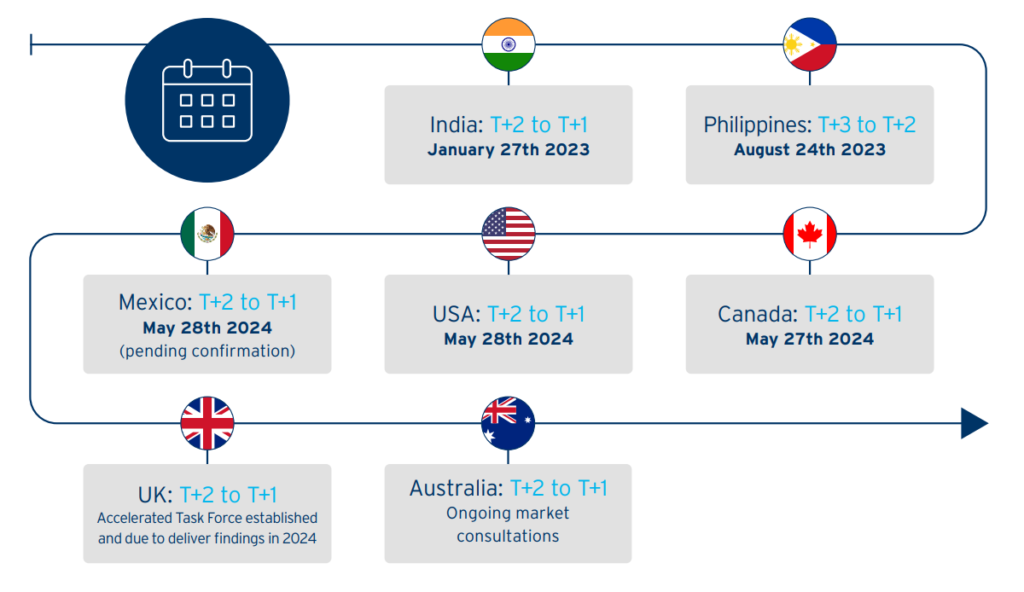

The release of Citi’s comprehensive latest report, “Securities Services Evolution,” underscores India’s recent manoeuvre towards T+1 settlements. This strategic move ensures the culmination of all trade-related settlements within a 24-hour window of a transaction. With the United States, Canada, and other leading economies intensifying their endeavours to migrate towards T+1 settlement periods, the survey by Citi scrutinizes the pivotal role played by Distributed Ledger Technology (DLT), CBDCs, and stablecoins in facilitating this transition.

From a pool of 483 survey participants and 12 financial market infrastructures (FMIs), a substantial 87% recognise CBDCs as a feasible avenue to abbreviate settlement cycles by the year 2026. The enthusiasm for CBDCs among securities firms has surged by an impressive 21% compared to the previous year.

The progressive growth in approval for digital fiat currencies year after year is bolstered by domestic trial runs and cross-border ventures. The Citi report expounds:

“Recent multi-bank cross-border experiments are presently furnishing intricate insights into the pragmatic implementation of central bank backing in a digital landscape, both within internal frameworks and across entire markets.”

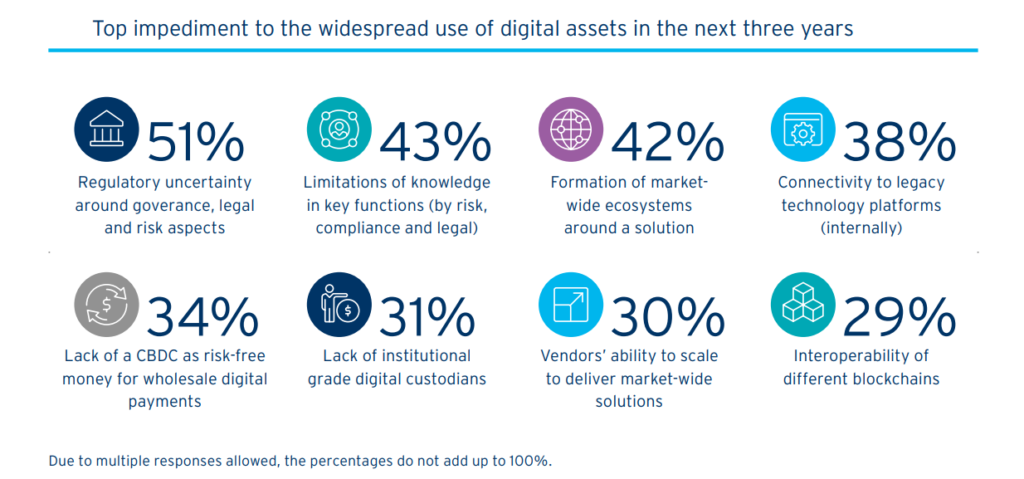

Nevertheless, over the coming years, the widespread adoption of digital assets faces several noteworthy obstacles, including ambiguities in regulations, limited awareness, compatibility issues with conventional financial systems, and blockchain interoperability, among other challenges, as enumerated below:

Among the various financial establishments subjected to the survey, institutional investors, banks, and asset management firms exhibit the most substantial capacity to expand and deliver comprehensive solutions. This capability is a crucial determinant in the extensive adoption of CBDCs, stablecoins, and other financial instruments subject to centralised governance.

Citi’s report envisions that by 2028, financial aspirations will surpass the T+1 benchmark. Anticipated transformations encompass the assimilation of Distributed Ledger Technologies into the mainstream, abbreviated settlement cycles, mechanisms centered on digital cash, and the eventual obsolescence of core banking systems.

Merely a month following India’s proposal to engage 18 central banks in cross-border transactions through its CBDC, the Reserve Bank of Australia has successfully concluded its in-house CBDC trial. The Australian central bank posits that a CBDC could potentially invigorate financial innovation, particularly in domains like debt securities markets, while simultaneously fostering progress in emerging private digital currency sectors. This, in turn, could enhance resilience and inclusivity within the broader digital economy.